If you’ve ever dipped so much as a toe into investing, you’ve probably heard about the Standard & Poor’s 500 Index.

The S&P 500 is the most common index used to track the performance of the US stock market. It is based on the stock prices of 500 of the largest companies that trade on the New York Stock Exchange or the NASDAQ.

The S&P 500 is often hailed as a representation of the entire US stock market and American business as a whole, but that is not entirely accurate. While it gives you exposure to a broad swath of the economy, it is heavily weighted toward specific market capitalizations, sectors, and industries, which is important to know if you want to build a diversified equity portfolio.

S&P 500 Market Capitalizations

By design, the S&P 500 includes only large companies. Only the biggest companies with massive market capitalizations ($13.1 billion or more) are included—think of large firms such as Apple, Microsoft, Amazon, Meta (formerly Facebook), and Alphabet, the parent company of Google. One could argue that the S&P 500 is 100% weighted toward large-cap firms, although many of the biggest firms would technically be considered mega-cap.

It’s important to know that while investing in the S&P 500 can give great returns, you may be missing out on returns from medium-sized and small companies. If you’re looking for exposure to smaller firms, you should consider investments that track the S&P 400, which consists of the top mid-cap companies, or the Russell 2000, which features mostly smaller companies.

note

Businesses with smaller market caps generally carry more risk than large-cap ones. You should ensure that your portfolio and risk tolerance can handle the volatility of smaller cap companies.

S&P 500 Sector and Industry Weighting

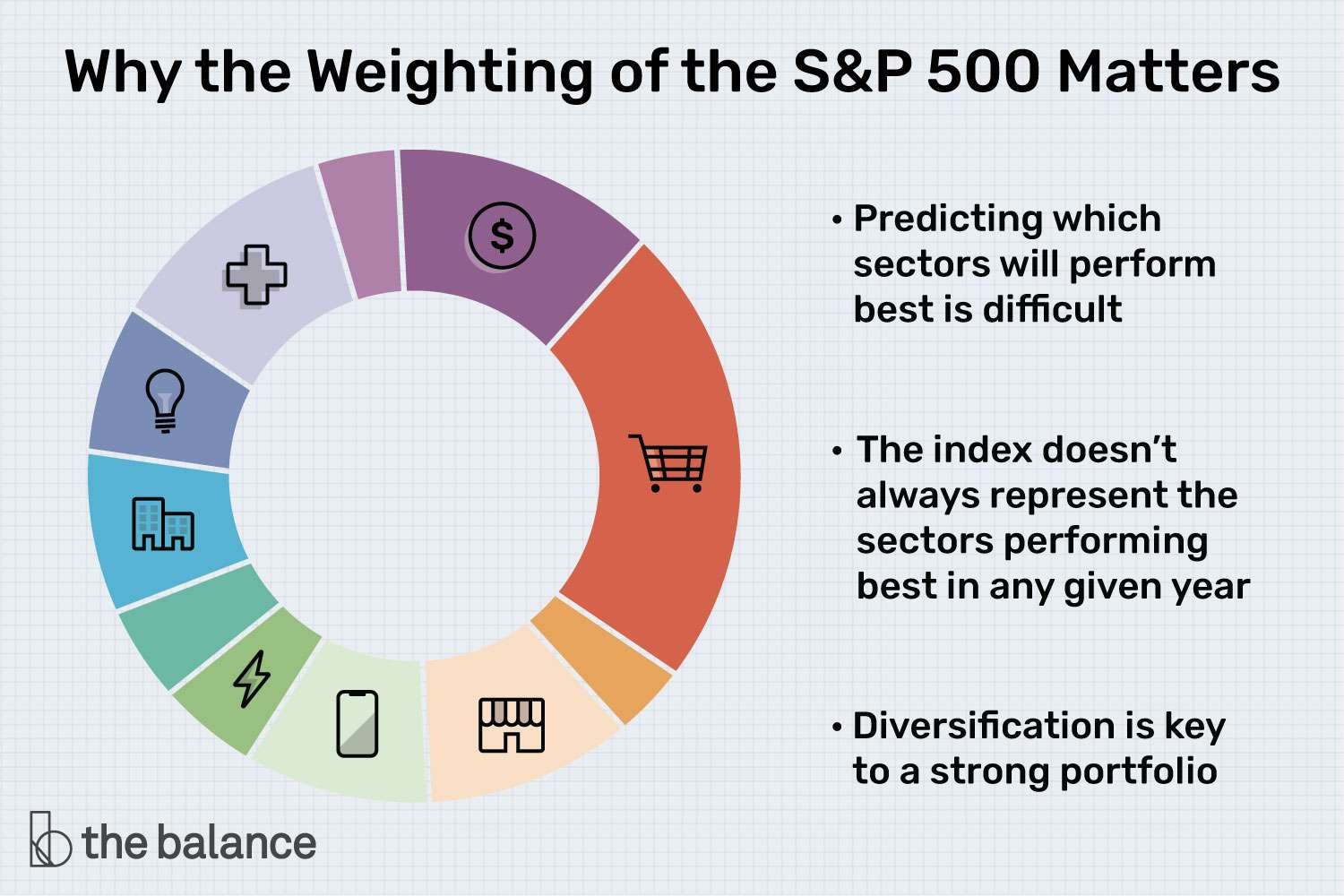

Any attempt to diversify your stock portfolio should include some attempt at diversification according to sector and industry. In fact, some investment strategies suggest a perfect balance of sectors, because any sector can be the best-performing group in any given year.

In recent years, certain sectors and industries have performed better than others, and that is now reflected in the makeup of the S&P 500. It also means that many sectors won’t be as represented in the index.

The breakdown of sectors in the S&P 500 is as follows:

- Information technology: 28.1%

- Health care: 13.3%

- Consumer discretionary: 11.8%

- Financials: 11.5%

- Communication services: 9.6%

- Industrials: 8%

- Consumer staples: 6.2%

- Energy: 3.7%

- Real estate: 2.6%

- Materials: 2.6%

- Utilities: 2.6%

As you can see, the S&P is heavily weighted toward tech, health care, and consumer discretionary stocks. Meanwhile, there aren’t as many utilities, real estate companies, or firms involved in producing and selling raw materials.

note

This weighting has changed greatly over the years. Look back 25 years, and you’ll likely see far fewer tech companies and more emphasis on consumer discretion and communications companies. Go back 50 years, and the mix will look even more different.

Why It Matters

The weighting of the S&P 500 should be important to you because the index does not always represent the types of companies performing the best in any given year. For example, while consumer discretionary may have been the top-performing sector in 2015, it ranked third in 2017 and seventh in 2019. The communications services sector came in last in performance in 2017 after ranking second one year earlier. Amid the financial crisis in 2007 and 2008, the financials sector was the lowest-performing sector, but it rose to claim the top spot in 2012, then performed third-best in 2019.

Predicting which sectors will perform best in any given year is very difficult, which is why diversification is key to a strong portfolio.

How To Supplement the S&P 500

Investing in the S&P 500 through a low-cost index fund can provide a very strong base for most stock portfolios. But to get broad diversification among market caps and sectors, you might consider expanding your reach.

Fortunately, mutual funds and exchange-traded funds (ETFs) can provide exposure to whatever you may be seeking. For example, if you’re looking to boost your portfolio by purchasing small-cap stocks, you can buy shares of an index fund designed to mirror the Russell 2000. If you want to invest more in financial stocks, you can access funds comprising a wide range of banks and financial services firms.

There are also mutual funds and ETFs that offer broad exposure to the entire stock market, including all market caps and sectors. Vanguard’s Total Stock Market ETF and the S&P Total Stock Market ETF from iShares are two popular examples.

A Word About International Equities

Most investors who build their portfolios entirely out of US equities will probably do fine. America is still the largest and most dynamic economy in the world; However, there are many instances when events and growth cycles allow markets outside the US to perform better.

Many financial advisors suggest carving out a portion of your stock portfolio to equities based in Europe, Asia, South America, and emerging markets. There are many mutual funds and ETFs that are designed to take advantage of these non-US opportunities.

Frequently Asked Questions (FAQs)

What are the strongest sectors in the S&P 500?

The energy sector has outperformed the S&P 500 as a whole by the widest margin in the past year. The information technology sector was also stronger, although to a lesser degree, as was the real estate sector.

What sectors are lagging behind the S&P 500’s performance?

Communications services have performed well below the S&P 500 as a whole over the past year. The industrials, materials, and consumer staples sectors also lagged.

How do miners fit into the S&P sectors?

Miners and mining are considered part of the materials sector.